Recent data revealed 8.1% of Utahns were uninsured in 2022. BYU ensures none of its students are uninsured.

BYU’s health insurance policy

According to BYU’s Health Center website, all students enrolled in classes three-fourth time or more must have “appropriate medical coverage for the duration of their enrollment at BYU.”

Students are required to either submit proof of private insurance or enroll in BYU’s student health insurance plan.

Aaron Larson, the finance director of BYU Health Services, has worked in college health for 20 years and said it’s very common for universities to require students to have health coverage.

BYU requires students to have health insurance for the benefit of their health and wellbeing, Larson said. The expenses of healthcare without insurance can add up quickly.

“If it becomes a financial issue … it can become a deterrent for taking care of oneself,” Larson said.

The university doesn’t want health barriers to prevent students from taking care of themselves and continuing their education, he said.

Carl Hanson, a public health professor at BYU, said health insurance is a financial safety net for times of need and not having it is taking a gamble.

Having regular access to a healthcare provider allows for preventative care such as screenings, vaccinations and regular check ups, he said.

“An ounce of prevention is worth a pound of cure,” Hanson said.

BYU’s insurance plan for students and dependents

According to Larson, about 7,000 people enroll in the BYU student health insurance plan yearly, which is about 20% of the university’s student body. However, not all of the people enrolled are students, as some of them may be spouses and dependents, he said.

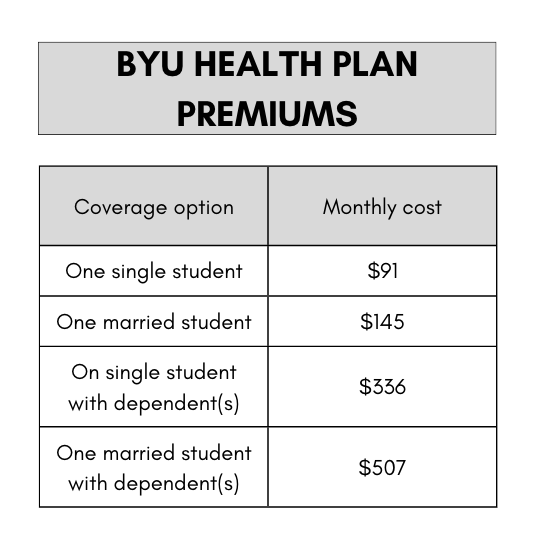

BYU’s health insurance costs $91 per month for one unmarried student, and $145 monthly for one married student. A dependent plan is $336 a month to include as many dependents as the student has, and $507 a month to include a spouse as well, according to Larson.

He said married students are fully covered for the costs of having a baby, including OBGYN and maternity care, labor and delivery and subsequent costs. Children can be added as dependents.

As of early 2023, coverage for contraceptives, such as prescriptions and IUDs, were made available to married people on the student health plan.

How does BYU’s insurance plan compare to others?

Larson said while this can seem like a high monthly expense to some college students, it’s a relatively low cost for the value of BYU’s health plan.

The student plan has no deductibles and is “first dollar coverage,” meaning if you have an insurance claim there will be coverage from day one no matter what, he said.

These benefits prevent users from having to pay more money out of pocket when health issues come up, Larson said.

“I would recommend to maybe think, take a moment to think about the actualities of possibly getting sick. It’s kind of one of those considerations you start to think about as an adult,” he said.

Using the BYU health center

Abigail Overson, a construction and facilities management major from Hillsville, Virginia, has been using BYU’s student health insurance for more than three years, since her freshman year.

The main reason Overson chose to use the BYU health insurance plan was because of convenience, she said. Students are automatically enrolled if they don’t show proof of private insurance.

Overson uses the insurance for regular check-ups at the campus health center, a “comfortable and judgment free space,” she said.

Another reason she continues to choose the BYU health insurance plan and health center is because it offers options for mental health, as well as physical health, Overson said.

“I did counseling there for a while and so that was nice to have access to that as well,” she said.

The plan will cover counseling with external therapists up to a certain percent, Overson said, but it’s cheaper to use the services offered at the health center.

Overson said she was annoyed by the health insurance requirement and the monthly expense at first, but decided to stick with it rather than seek cheaper options and to fully utilize the health coverage by having regular check-ups.

The coverage is sufficient for Overson’s regular health needs, but that someone who needs doctor visits less frequently may be able to get by with a cheaper, less comprehensive option, she said.

Morgan Bell, an exercise science major from Illinois, said she uses the BYU health insurance plan because it’s more affordable than other options.

The center is convenient and accessible because it is right on campus, Bell said. The only inconveniences are that BYU’s insurance doesn’t include dental coverage, and that she has to get a referral before seeing any specialists outside of BYU’s health center.

“I understand why they do it, but it is … kind of a hassle,” she said.

BYU’s health center accepts private insurance plans as well as the student plan

The BYU health center is open to all students, not just those on BYU’s insurance plan, Larson said.

“The doctors here are contracted with pretty much any insurance you can bring … so it’s an option for any student,” he said.

Prior to the passing of the Affordable Care Act over a decade ago, the campus health center was exclusively for students with BYU’s insurance plan, but that changed when the act was passed to include more people with various types of insurance, Larson said.

Nate Hill, an English major from Spanish Fork, is covered by his parents’ health insurance plan. He said he chose to go to BYU’s health center rather than a family doctor for the convenience of having a doctor on campus.

“It’s really fast, it’s convenient, it’s right on campus,” he said.

Finding affordable health insurance

While the BYU student health insurance plan is a comparatively affordable option, students have many options to explore and find health insurance plans, Larson said.

Hanson said individuals seeking a private health insurance plan that fits their needs and situation should start with the health insurance marketplace, which can be accessed at Healthcare.gov.

Lower income students and families may be eligible for public health insurance, such as Medicaid, Medicare and others, Hanson said.

“A proactive approach to health is the best prescription … As we invest in wellness today, we will thrive tomorrow,” he said.