BYU senior Levi Wilson recently created the app Graduly, which uses BYU’s Financial Loan Calculator tool to help students calculate their student loan debts.

Graduly helps students manage student loans with an online financial calculator. Students can input their financial information to see projected summaries of loan debt.

“The tool is just really helpful for students to understand their financial situation, how much student loan debt that they need to take on, and how much they can’t take on,” Wilson said.

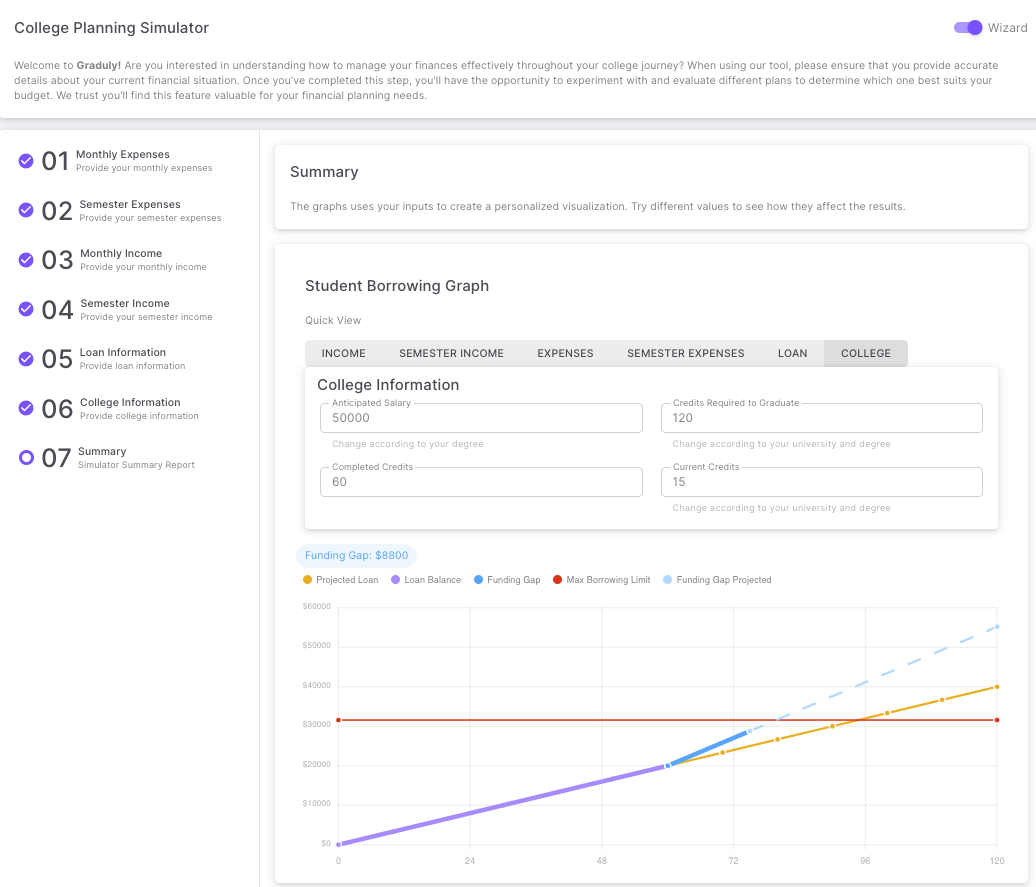

The financial calculator allows students to enter their expenses, income, loan information and college information.

“Once (the students) do that, it’ll take them to a summary page where they’ll see how much their next semester of college is going to cost. And if they have any loan debt, it’ll project out how much loan debt are you projected to take out,” Wilson said.

Wilson worked with Paul Conrad, the manager of BYU’s Financial Fitness Center, to develop Graduly. Conrad developed BYU’s Financial Loan Calculator to help students understand their financial situation and figure out how they can fund their college careers.

Conrad explained the Financial Fitness Center has worked on the loan calculator for years. One of the tool’s aims is to help students find a way to manage their needs less expensively.

“I think that one thing that this tool does, in addition to helping students make good decisions, it gives them a context within which they can make these decisions,” Conrad said.

Graduly licensed the loan calculator tool from BYU to bring it to other universities. BYU students can continue to use the loan calculator offered through the Financial Fitness Center, which performs the same functions as Graduly.

“I’m pretty passionate about personal finance and making wise financial decisions,” Wilson said. “I think it’s a really big problem in society that we see right now where obviously there’s a student debt crisis where students are borrowing too much, and they can’t pay it back.”

October 2023 was the first month payments for student loans were due since the COVID-19 payment pause, according to Federal Student Aid. Borrowers were required to make their payment by the due date or consider applying for a different loan plan.

“BYU is a pretty cheap school all things considered, but even still it can be a pretty big burden on some people, especially those who were unable to apply for or forgot to apply for scholarships and who are working through college,” BYU freshman Ethan Yamashita said. “So learning about finances now, how to balance budgets, how to plan spending and what student debt means both now and later is very important for everyone.”

Wilson said Graduly aims to show students their return on investment to help them make better financial decisions.

Wilson said he plans to continue with Graduly after graduation and work with Summit Venture Studio to bring financial awareness to students.