Whether or not to buy renters insurance is a decision which many students may not be fully informed on.

On- or off-campus, students renting dorms or apartments have many new decisions to make, such as which laptop to buy or which classes to take. One question which many new students neglect to ask is whether or not to purchase renters insurance.

Renters insurance is exactly what it sounds like. Just as homeowners can qualify for homeowners insurance, people who rent can qualify for renters insurance to help cover costs for stolen items and damages caused by a variety of factors.

According to the Insurance Information Institute, only 65.4% of occupied housing units in the United States were owner-occupied in 2020, meaning that nearly 45% of all occupied housing units were rented. Of those renting, 47.4% of tenants across the United States in 2021 spent more than 30% of their paycheck on rent and utilities alone.

With the average premium for renters insurance in the United States being $173 per year, many students who are spending a substantial portion of their income on rent may be wary of spending extra money to insure what little they have.

For poor college students, replacing stolen or damaged items without insurance can quickly become expensive. But just like any other type of insurance, different providers and plans cover different price ranges.

Some of the largest insurance providers, such as AAA, Progressive and Allstate, offer renter’s insurance. One of the most popular renters insurance providers for college students is GradGuard.

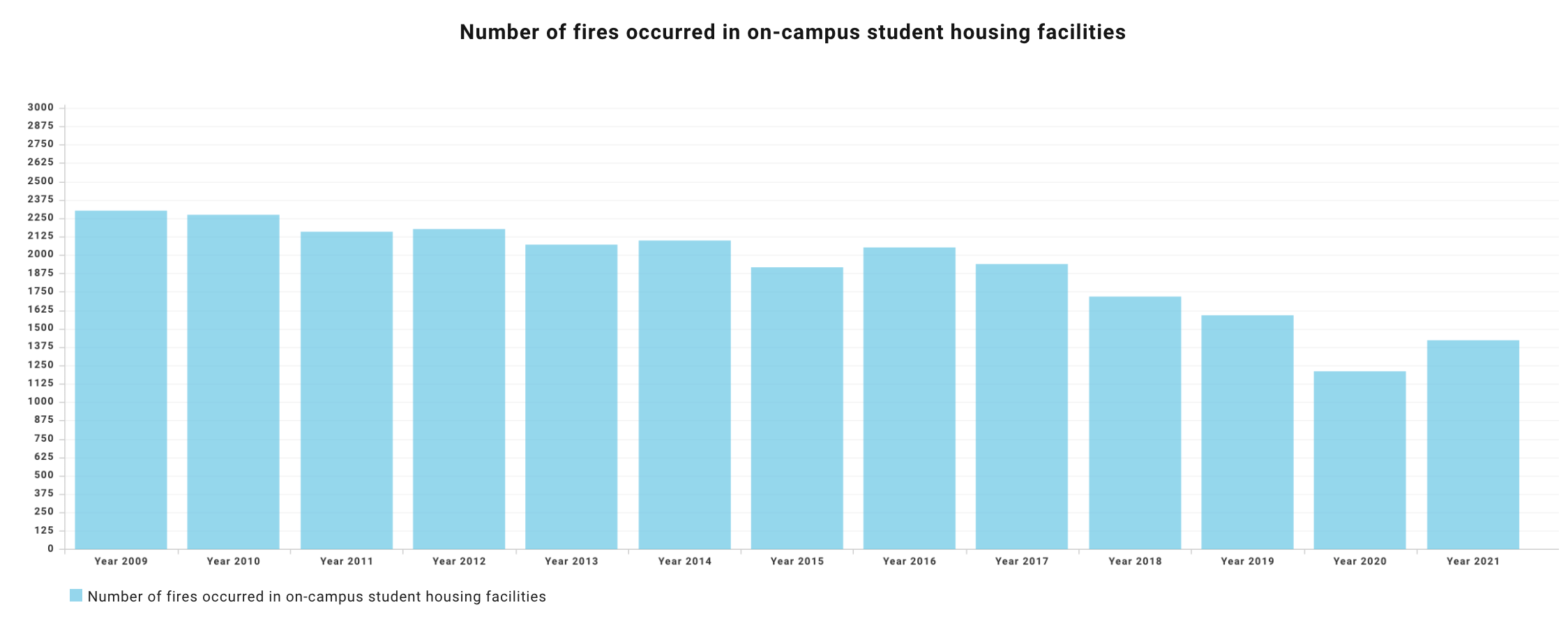

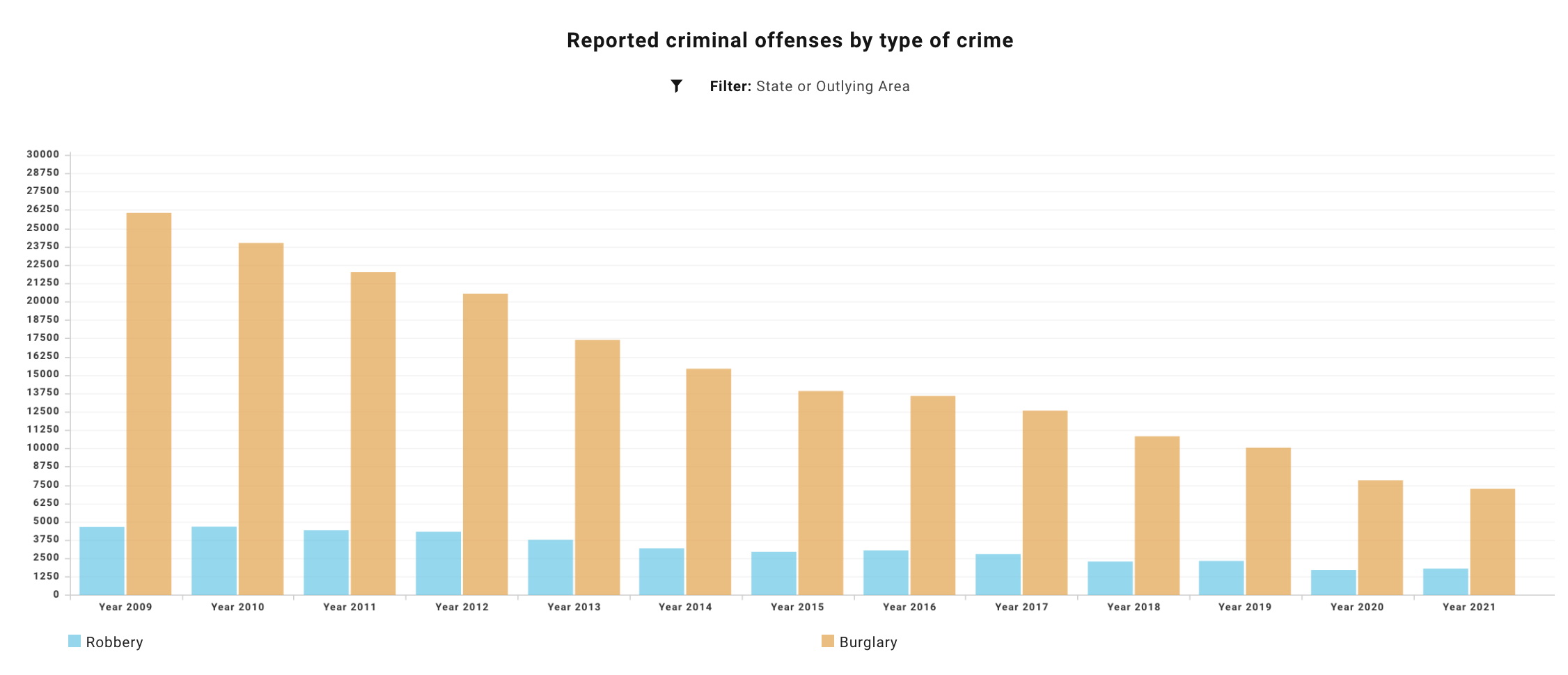

In a survey collected by the U.S. Department of Education’s Office of Postsecondary Education, there were more than 1,400 reported fires and 9,000 reported cases of burglary and robbery in on-campus student housing facilities in 2021 alone.

According to GradGuard’s website, a standard policy protects renters against theft of items like clothing and tech, water damage and fire damage. While prices on monthly payments may vary, quotes for renters insurance from GradGuard are typically around $15 a month for on-campus living and $20 a month for off-campus living in Provo.

“(Renters insurance) doesn’t cost that much,” said BYU sophomore Tyler Callum, “and (it) could help you save a lot.”

Callum currently rents an apartment off-campus. Callum does not currently pay for renters insurance, but he said he still thinks peace of mind is worth the payment. However, not everyone agrees that renters insurance is worth having.

Logan Bonine is a first-year master’s student at BYU. When asked whether he thinks his renters insurance is worth the monthly cost, he said, “I’ve never (had) an issue with it, so honestly, I wish I didn’t have to pay for it … I didn’t (pay for it) on campus, so I think it’s kind of useless.”

First-year BYU student Lincoln Riding is currently renting a dorm and pays for renters insurance. Even though he said he does not currently feel like the premium is worth it, he does think it would be helpful in some scenarios.

“I can see where having a crazy roommate would be worth the renters insurance,” Riding said, “just to make sure that you don’t lose anything or have the building damaged.”

BYU recommends that each student has at least some insurance to help protect themselves and their belongings.

BYU Housing Guidelines and Policies state, “Although tenants’ parents’ homeowners insurance may cover tenants’ personal belongings while they are at school, BYU recommends that tenants purchase renter’s insurance.”

Since BYU does not provide renters insurance, students will have to look for outside providers to make sure their belongings are covered.

“The university does not accept responsibility for personal belongings that are damaged or stolen in the residence halls,” the Housing Guidelines and Policies said.