Governor Spencer Cox signed historic tax cut package HB54 into law last month, and some Utahns are wondering who it will most benefit.

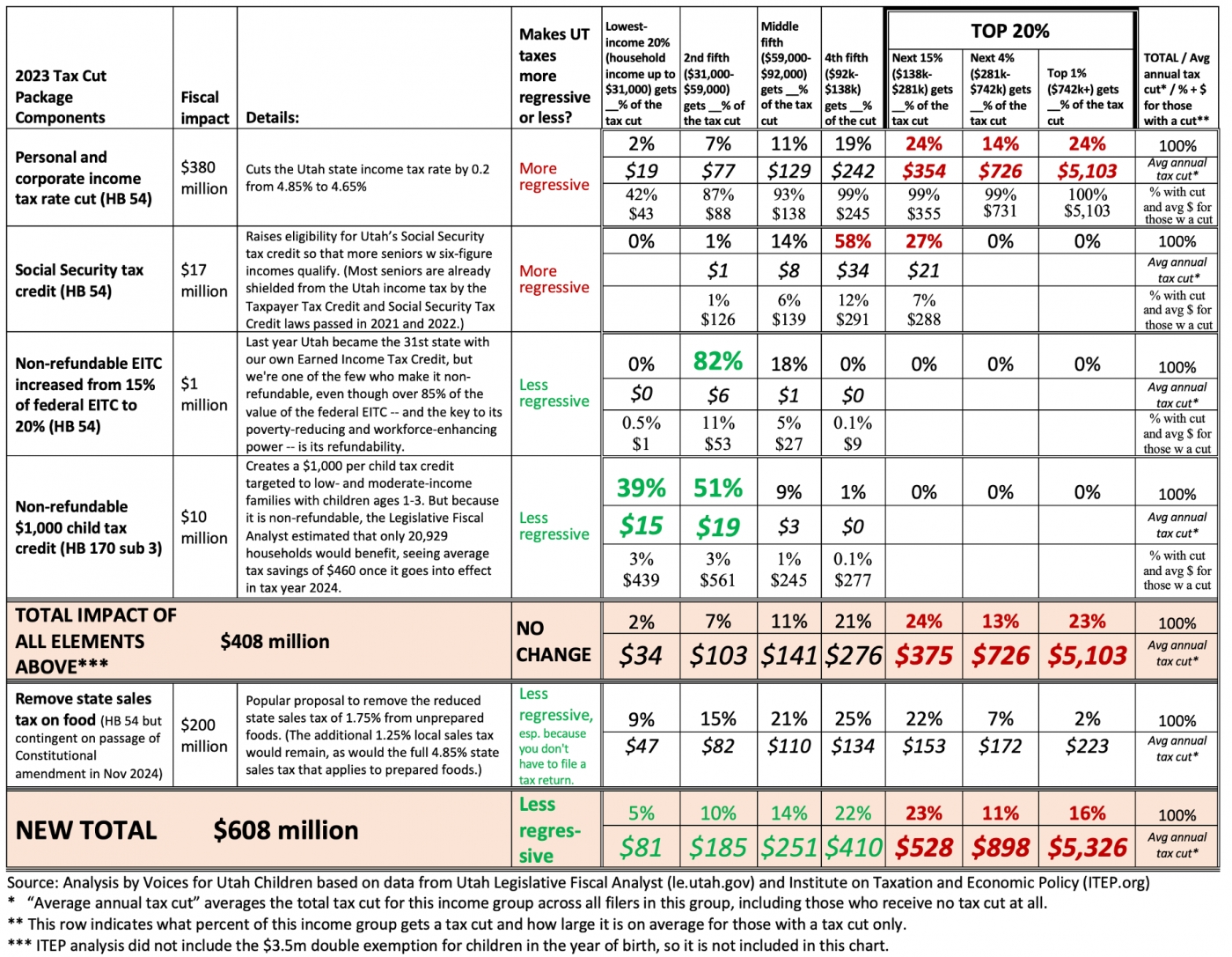

HB54, the largest tax cut package in Utah history, according to Governor Cox, will go into effect on May 3 of this year. The bill lowers the state income tax for individuals and corporations from 4.85% to 4.65%.

Additionally, HB54 allows Utah women to claim a double-dependent exemption for their child in the year of their birth. While each member of a household qualifies a family for an additional tax exemption, the new provision will allow for a family to receive two exemptions for one child the year of the child’s birth. As of 2021, the Utah personal exemption equated to $1,750, which would amount to a $3,500 exemption the year a child is born.

The new package also provides a Social Security credit for retirees receiving Social Security and supports a constitutional amendment to reduce the sales tax on food, which will be on the ballot this fall.

The Utah legislature has prioritized tax cuts in the past several years, with 2023 being no exception.

In a February press release, J. Stuart Adams, president of the Utah Senate, said 2023 will be known as the year of the tax cut.

“For the third year in a row, we will return money to the hard-working Utahns who earned it. We will continue to promote long-term investments that help families, individuals and businesses succeed,” Adams said.

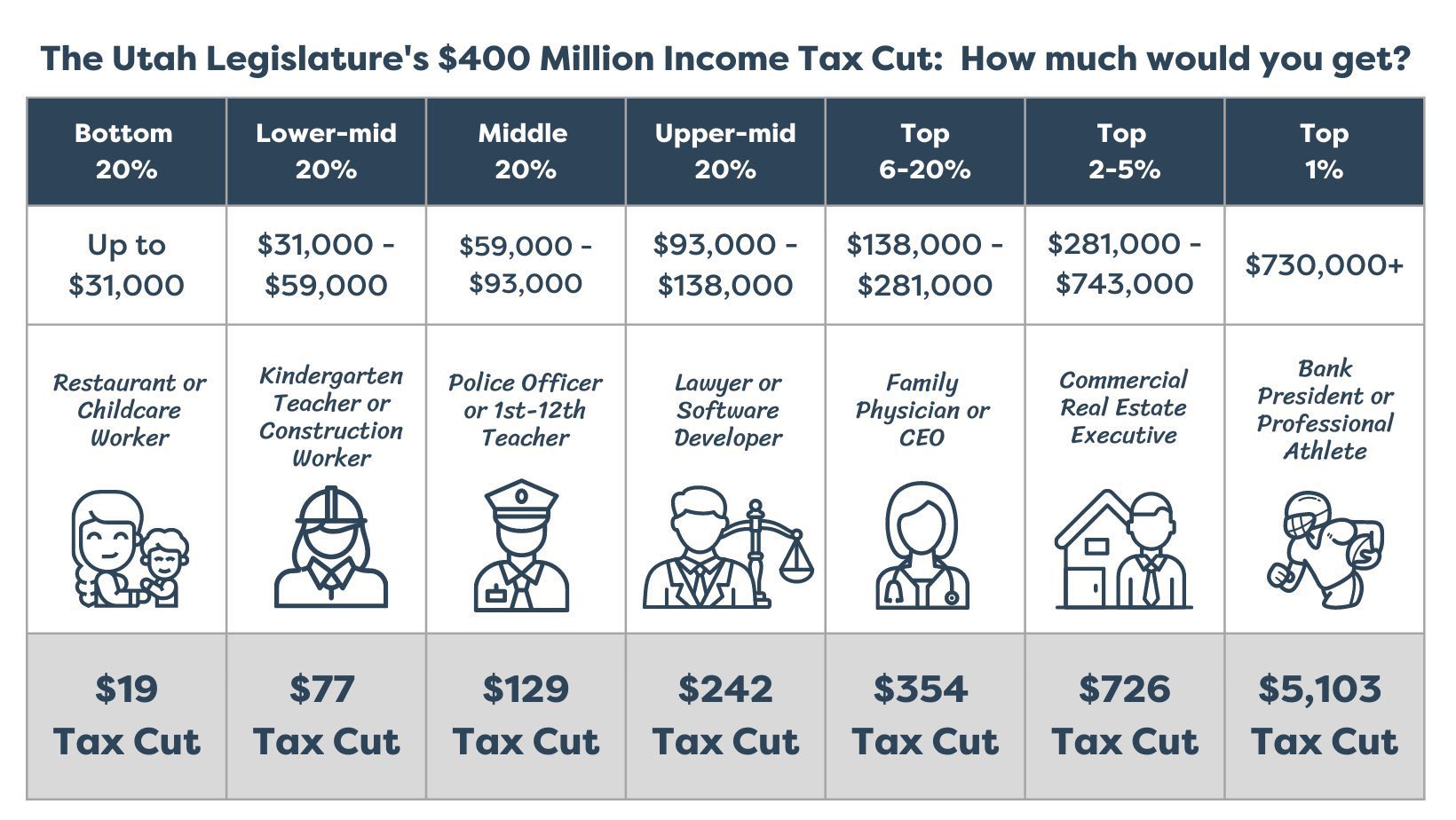

By reducing Utah’s income tax rate from 4.85% to 4.65%, it is anticipated the average family of four making $80,000 will see a cut of roughly $208 dollars. Some Utah constituents are asking why the legislature is continuing to prioritize tax cuts when the majority of Utahns only see fractional benefits.

“We have cut taxes quite a bit in recent years and it’s mostly been the income tax we’ve been cutting,” said Matthew Weinstein, state fiscal policy director for Voices for Utah Children. “This year the income tax cut was over 400 million dollars, last year it was 200 million dollars, the year before that 100 million dollars. Every time you cut the income tax you are cutting the one tax that isn’t a regressive tax, so you’re making our overall tax system more regressive.”

Regressive taxes are any in which lower income earners have higher tax rates.

The Utah income tax is one of the least regressive taxes in Utah, with most of the tax being paid by high-income Utahns.

“The top fifth of Utahns are earning about three-fifths of all income in Utah. Utah’s income tax lines up with its income distribution, the only tax where this is the case,” Weinstein said.

According to Weinstein, those in the lowest income quartile do not receive a tax cut when income tax rate is reduced because Utah has a taxpayer tax credit that shields the majority of low-income households from paying any income taxes.

“Because most low-income households are already paying 7.5% of their income in taxes, not through the income tax but through the sales, gas and property tax, the idea is that the income tax should be the one tax that isn’t a regressive tax,” Weinstein said.

John Barrick, an accounting professor in the BYU School of Accountancy, said there are three types of taxes people pay to states: income, property and sales. Both property and sales taxes contribute to local school districts and communities.

While the federal government can easily issue debt if they need more money, Barrick explained most state governments are required to be in the black, or operate on a balanced budget. Because of this, it is possible for states to accrue a surplus of money from taxes.

“Utah raised a $480 million dollar surplus, which means the taxes they raised were about half a billion dollars more than what Utah spent as a state. So, then the question is what you do with that,” Barrick said.

From the prevalence of tax cuts in this year and years previous, it is clear politicians prioritize passing tax cut legislation. However, some Utahns are critical of prioritizing tax cuts when taxes such as the income tax are working well for the income distribution of Utah.

Invest in Utah’s Future is a coalition comprised of Utahns from across the state who strive to focus public attention on various issues relating to Utah’s future. In a January news release, Invest in Utah’s Future “called on the Utah Legislature to prioritize addressing Utah’s long and growing list of unmet needs over permanent tax cuts that undermine our long-term capacity to invest in Utah’s future.”

Citing the Utah Foundation’s 2020 report which reported Utah’s tax burden being the lowest it has been in 25 years, the coalition presented a list of 28 urgent unmet needs amounting to $5.6 billion that the state could use the budget surplus on, in opposition to additional tax cuts.

“I think a lot of what’s going on is politicians giving in to the tax cut temptation. It’s easy to do and they want to be able to say to their constituents come election time, ‘I gave you something, I put a couple hundred dollars in your pocket,'” Weinstein said.

Whether or not Utahns are pleased or frustrated with HB54 is dependent on personal political ideologies, Barrick explained.

“The question is do we want to fund education more, or do we want to give the money back to the people and let them decide? And that is a political choice,” Barrick said.