The much-anticipated movie “Mission: Impossible — Fallout” was released in July. MoviePass users Kirsten Card and her husband, Ben, rushed to the theater to see what would unfold for Tom Cruise as he embraced his next thrilling mission. However, they found their own mission impossible as they tried to enter the theater.

“They blocked the movie I wanted to see,” Kirsten Card said. “If I can’t see the movie I want, what’s the point? It’s so annoying.”

MoviePass introduced a $9.95 per month subscription-based movie model in August 2017 that allowed users to see one movie per day, prompting more than three million customers to join.

The subscription-based movie ticket model MoviePass created — which was planned to be paid off by selling data to theaters and other merchandisers long term — has disrupted the industry as theater chains and others roll out competing plans.

“I think the idea of subscription was novel and innovative,” BYU professor of marketing and entrepreneurship Gary Rhoads said. “I think MoviePass is going to go under most likely, but now other companies are going to learn from their mistakes and be profitable.”

MoviePass has made several new stipulations since introducing the plan of one-movie-per-day for $9.95 per month in August 2017.

One movie per day was reduced to three movies per month, and MoviePass users were no longer allowed to see newly released movies until they had been out for two weeks.

“I went to see the Christopher Robin movie the other day, and I was annoyed to find out that it was blocked. I had to pay for the ticket on top of paying for my MoviePass,” said Kaylie Smart, a former MoviePass customer.

A peak pricing increase was also added to any movie ticket when a theater reached a certain undisclosed percentage of its capacity.

“I was really annoyed when the first two movies I wanted to see were blocked, and then my third choice was $3.41 more than I’ve ever had to pay before,” Ben Card said. “I had no idea they would charge me more if the theater was filling up.”

MoviePass users are no longer allowed to view a movie more than once. On its website, MoviePass FAQ explains the logic behind the change, saying, “We hope this will encourage you to see new movies and enjoy something different!”

MoviePass user Allie Howell did not find this change as helpful as the company described.

“They won’t let you see the same movie twice now, and that’s annoying because sometimes I would go to a movie with one friend and then want to go to that same movie with another friend later,” Howell said.

For a time, MoviePass also required customers to submit pictures of their ticket stubs.

“It was a pain when they made us take pictures of our tickets, but I still thought it was worth it,” Kirsten Card said. “But when they just completely blocked the movie from us, it was game over.”

MoviePass heard its customers’ complaints and no longer requires them to submit a ticket stub picture. The company also eliminated peak pricing when a theater begins filling up and modified the new release restriction to only block selected new releases.

“As we continue to evolve the service, certain movies may not always be available in every theater on our platform,” MoviePass CEO Mitch Lowe said in an email to subscribers.

On July 31, MoviePass announced a price increase from $9.95 per month to $14.95 per month starting in August 2018. However, on Aug. 6, MoviePass went back on the announcement.

“We have heard — and we have listened to — our MoviePass Community and we will not be raising prices to $14.95 a month,” the company wrote in a press release.

Rather than raising prices, MoviePass announced a plan that allows subscribers to view three movies a month for the original MoviePass price of $9.95. However, according to Business Insider, the new plan limits the films and showtimes available each day. The schedule of available movies is available online.

The frequency of change in policies seems to be adding to the frustration as customers are no longer sure what is possible with their pass.

“Even three movies at $9.95 is a great deal, but I don’t have confidence in them anymore because they’ve changed so many things, and they say you can go to the movies, but my pass shows most movies are blocked,” Rhoads said.

In a press release, MoviePass said more people are seeing movies due to the prices provided by a MoviePass subscription.

“Overall, we believe as much as six percent of the industry’s total box office receipts can be traced to our loyal subscribers. It’s clear that because of MoviePass, more people are seeing more movies at fair prices.”

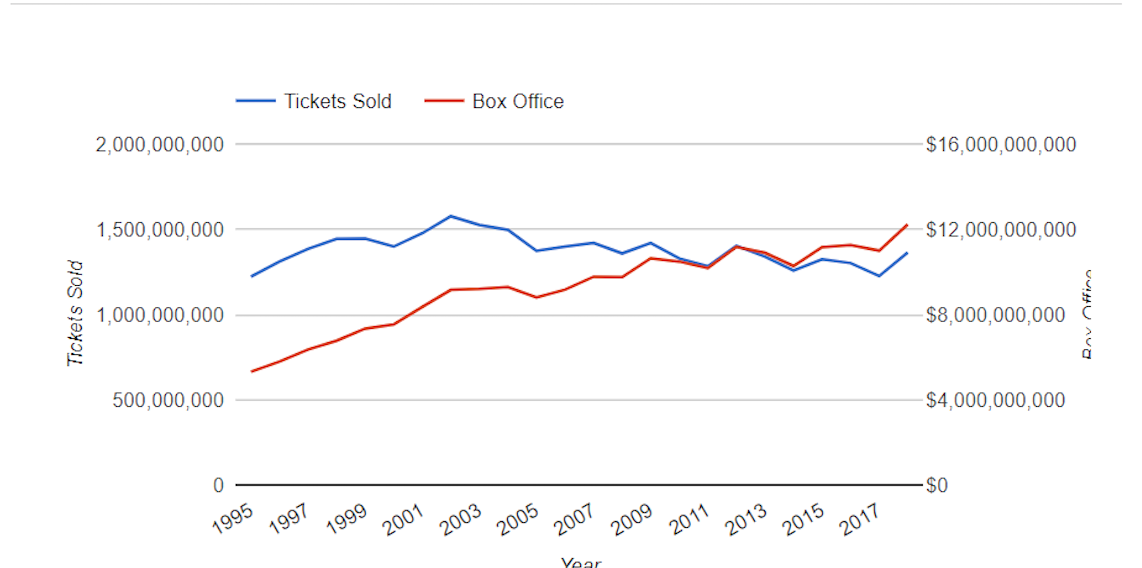

The Numbers, Where Data and the Movie Business Meet, reports a declining trend in movie tickets sold since 2002. However, the trend took a strong uptick from 2017 to 2018 — tickets sold in 2018 are projected at an annual rate based on tickets sold so far this year.

To support its claim in the same press release, MoviePass stated 23 percent of the tickets sold for Lionsgate’s “Blindspotting” in its opening weekend, 17 percent of first night previews of Paramount’s “Book Club,” 13 percent of the Warner Brothers’ opening weekend domestic box office totals for “Tag” and about 12 percent of the entire theatrical run for Magnolia Pictures’ documentary hit “RGB” were all purchased by MoviePass members.

For the movie “Beast,” MoviePass-supported theaters grossed 55 percent higher than theaters that MoviePass does not support.

During the July 4 holiday week, MoviePass accounted for over five percent of Universal Pictures’ “First Purge,” playing on more than 3,000 screens. MoviePass purchased more than 150,000 tickets for the movie during the week.

At its core, MoviePass plans to lose money by buying movie tickets and letting its users go to the theater for free after their first movie each month. In exchange for that loss, MoviePass has planned to collect data about its user base and leverage that data to make money.

In addition, a restaurant or ice-cream parlor near a theater could pay MoviePass to advertise to a movie patron who is currently seated in the nearby theater. Another option is that toy companies could do targeted advertising to a home where children just saw a popular animated film. Major studios could direct their marketing dollars to the exact audience who viewed similar movies in the past.

Helios and Matheson Analytics Inc., MoviePass’s largest shareholder who owns 78 percent of the company, is a big data company that sees great value and opportunity in mining the data MoviePass gathers. But that data only gets interesting when it represents millions of people. Hence, the willingness to lose money in order to attract a larger audience.

Unfortunately, this plan to sell data has not been as profitable as the company had planned. And with customers paying a monthly fee that amounts to roughly the price of one movie ticket, the financial losses have been staggering.

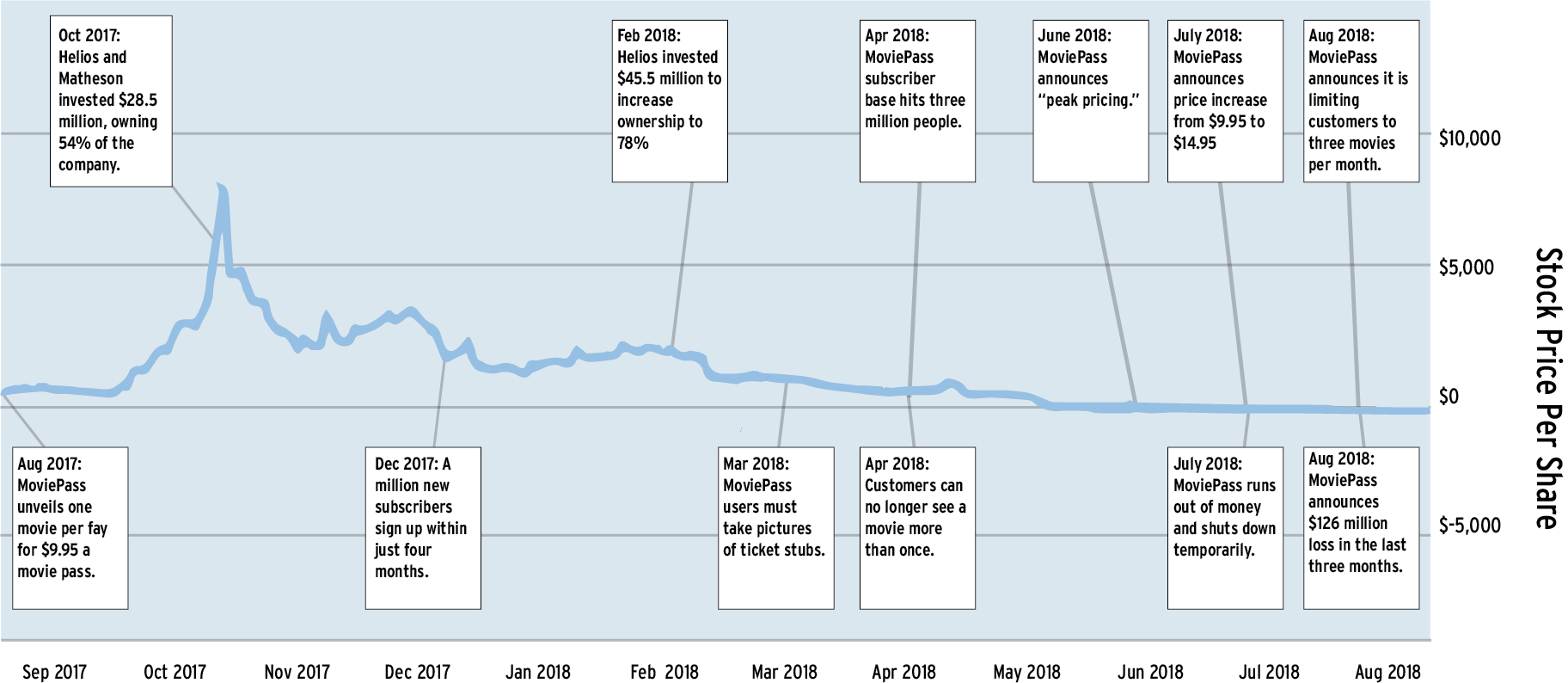

In August, MoviePass’s parent company, Helios and Matheson Analytics (HMNY), announced a $126 million loss in the second quarter, which ended June 30.

On Aug. 15, Helios and Matheson Analytics stock closed below 5 cents per share. In comparison, shares traded as high as $9,714.38 on Oct. 11, 2017.

“When a company stock price drops and stays below $1 for 30 consecutive business days, it’s at risk of being delisted,” said Paul Smart, president of private investment company Smart Capital, Inc.

“In this case, NASDAQ will probably notify HMNY, which is the majority stockholder of MoviePass, and give them 180 days to get their stock price back above $1. MoviePass is going to have to act fast.”

When MoviePass started in August 2017, it was the only subscription-based movie pass available. Since then, three competitors have jumped into the new movie subscription-based market.

“All their tactics and strategies were good, but when they didn’t have a well-thought-out crisis management process, that really hurt them. They should have seen it coming and developed a management process, but they didn’t. They fumbled through it, and it really hurt them,” Rhoads said.

Sinemia offers members two movie tickets per month for $9.99 per month. One advantage Sinemia offers over MoviePass is the ability to reserve a ticket before going to the theater. MoviePass users must be within 100 yards of the theater to reserve a ticket.

Cinemark Movie Club offers one movie ticket per month for $8.99. Cinemark Movie Club members also receive 20 percent discounts on concessions at the theater.

AMC Stub A-list costs $19.95 per month and gives users three movie tickets per week.