Editor’s note: As the Nov. 3 election draws near, the Daily Universe is exploring different national and local issues impacting voters in a series of stories.

The economy is usually a relevant issue during a presidential election, even during war time or, in 2020, the war against COVID-19. If employment and wages are up, the incumbent’s chance of reelection historically rises.

Unfortunately for President Donald Trump, COVID-19 changed the framework of the economy, creating an entirely different political landscape than what existed in January.

COVID-19: An economic hit

When the global pandemic spread across the United States, many employers had to lay off their workers. According to the Bureau of Labor Statistics, the unemployment rate went from an impressive 3.5% to a dismal 14.7% in the span of two months.

Not all states have been impacted equally, and Utah has done well in its overall economic stability. Val Hale, executive director of the Governor’s Office of Economic Development, highlighted Utah’s low unemployment rate — which is second only to Nebraska in the United States.

“There is no doubt that COVID-19 had a fairly dramatic impact,” Hale said. “Depending on the industry, some businesses have thrived and others have been decimated. The hospitality industry was hit hard, but outdoor recreation, restaurants and mail-order industries are hitting record-highs.”

Hale said he doubts Utah’s local and national election results will be changed by the economy alone, but economic disaster has a great potential to change the national election in other states.

“If you look at Hawaii, it has a tourist economy,” Hale said. “The state completely shut down and wouldn’t let anybody visit. People are much more passionate about COVID-19 response right now — either the state has done too much or too little.”

The shift in focus from the economy to COVID-19 is not surprising given the virus’s contagiousness. Hale said that has hurt President Trump’s chances of reelection.

President Trump’s economy

“A lot of people in January were thinking ‘unless something crazy happens, Trump is sitting pretty and has a really good chance to win,’” Hale said. “Of course, COVID-19 hit and nationally it’s really impacted the economy.”

The economy was in an excellent place before the pandemic arrived. According to reports from the White House, approximately 7 million jobs had been added to the economy since Trump took office. Unemployment was reduced by 1.4%, and poverty rates for Hispanic Americans and African Americans had hit new lows.

The pandemic has thrown economic uncertainty into an election. Polls suggest that likely voters think Trump has an edge with economic policy, but think candidate Joe Biden would do a better job with the pandemic, which would alleviate economic turmoil.

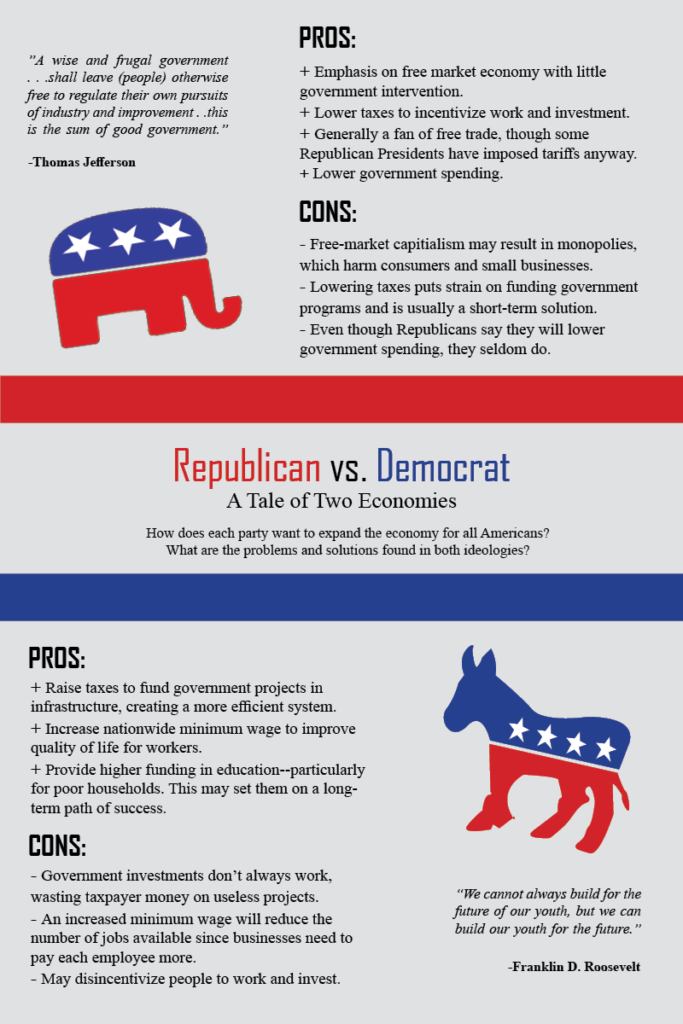

Republicans and Democrats hold dramatically different views on economic policy. Republicans try to minimize government intervention in the economy, while Democrats try to enact government policies to help spur economic growth.

Trump’s economic policy

A clear example of this comes from tax policy. Republicans generally favor tax cuts, while Democrats generally prefer tax increases. Mark Showalter, a BYU professor of economics, explained the difference between how each theory is supposed to work.

“Tax cuts have two effects,” Showalter said. “General tax cuts allow individuals to keep more of their earnings, which gives great incentive to work and to invest.”

Showalter said lowering taxes too much is a short-term solution to economic growth. If the government doesn’t receive enough taxes to fund programs like Medicare and Social Security, it might have to borrow more money in the long run.

“You want a tax policy that minimizes disincentives while still raising money for the payments needed,” Showalter said. “For example, much of the tax code Trump championed in 2017 was very reasonable and helpful to the economy.”

Trump’s tax plan cut taxes for 82% of American families, 20% of small-business owners, and lowered the corporate tax rate to 35% from 21%. Showalter said that while this tax plan was reasonable, Trump’s tariff policies have been much more controversial.

Tariffs are taxes on imported goods. In an effort to keep Americans buying local products, Trump raised tariffs on other countries, particularly China. This has hurt some businesses since American goods are more expensive than what other countries offer. It especially hurt the agricultural business in the United States.

“The problem with (Trump’s plan) is tariffs beget tariffs,” Showalter said. “The United States will start taxing Chinese goods, then China will start taxing U.S. goods. You can get into what’s called a ‘trade war.’ From an economist standpoint, tariffs are always a lose-lose situation.”

While Trump hasn’t laid out his specific economic plan, it is likely that he will continue to impose high tariffs on China and support a lower tax rate.

Biden’s economic policy

“Conceptually, raising taxes can improve economic outcomes if it doesn’t create too many disincentives for work,” Showalter said. “The government can use those revenues to build infrastructures like roads and ports. If the system of infrastructure in the United States is more functional, it could improve economic outcomes overall.”

According to the Washington Post, Biden’s tax plan will not directly impact middle-class workers, but employers may be forced to lay off employees to budget for the tax increase. Biden said he would raise taxes from 37% to 39.6% on people making more than $400,000 and would raise corporate taxes from President Trump’s 21% to 28%. These tax increases would fund government programs.

“One of Biden’s proposals is to make preschool available for everyone,” Showalter said. “In theory, poor households will have better schools, which will start them on a good economic path because of better education. They will have higher earnings down the road. This could lead to higher-paying jobs which means they will pay more taxes in the future.”

Showalter acknowledged that while Democratic policies sound excellent on paper, government programs might not go as planned.

“These investments don’t always work,” he said. “The government can waste money on useless projects that only make some people richer and some people poorer. That is the judgment the government has to make.”

Biden has made a few statements regarding Trump’s tariff policy. “It’s in our interest for China to be stable. It’s not in our interest for China to take advantage of us. We make up to 25% of the world economy and we’ve lost all our friends. (We) must insist we play by international rules,” Biden said in an interview with CNN’s Jake Tapper.

Vote and plan

No matter which side citizens choose to vote for, this election is definitely one to remember. The COVID-19 pandemic is changing the way people do business. The economy is still struggling in some states, and Americans are looking for solutions.

Hale said students need to prepare for their future careers, especially if they are graduating this year.

“Right now, the pandemic is controlling everything,” Showalter said. “Students who plan on graduating in April are likely to graduate into a poor labor market. The outcome of the election isn’t going to have that much of an effect on economic outlook in the immediate future. You have to be making career plans now.”