See also “Scholarships, loan options often drive students’ higher ed decisions”

Seth Frotman told his daughter on a seemingly ordinary Monday morning he would probably be home early from work and might be able to take her to the playground. In truth, Frotman was about to do something that would most likely get him fired.

Frotman was the assistant director and student loan ombudsman at the Consumer Financial Protection Bureau. His job was to look out for college student borrowers and make sure they were being treated fairly by financial companies, debt collectors and the federal government.

After 10 months under new leadership, Frotman felt that the bureau was not really trying to help students. He was frustrated, so he wrote a resignation letter and sent it to his boss. Frotman also forwarded this email to several U.S. senators and representatives, the U.S. Treasury Secretary and the U.S. Secretary of Education.

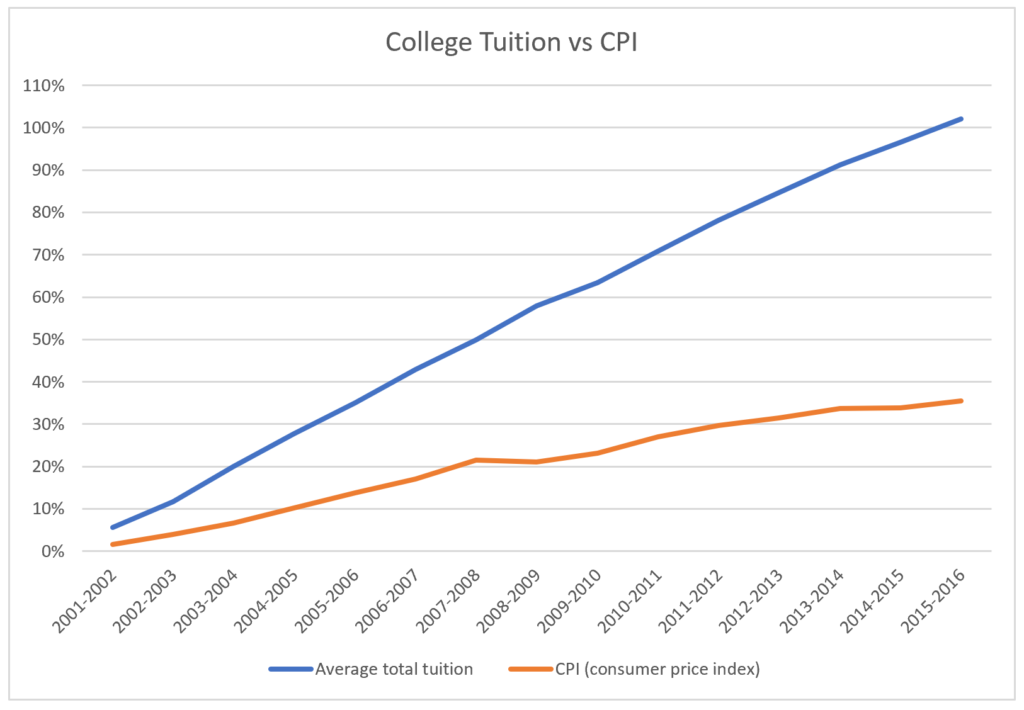

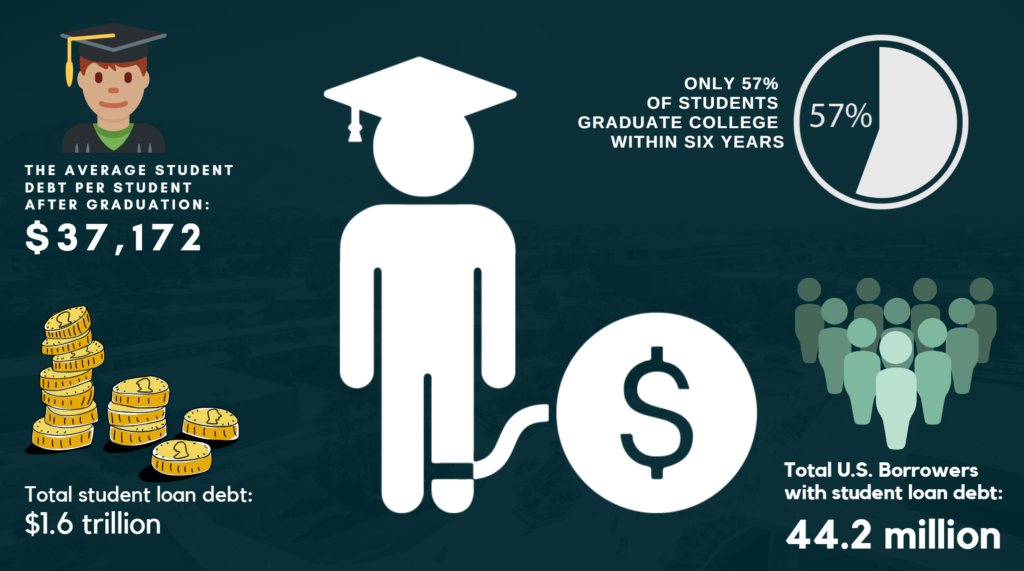

Frotman is not the only person who has been frustrated with the student loan system. Student loan debt in the U.S. now stands at more than $1.6 trillion. And with tuition and other college expenses more costly than ever, students are having to take out increasingly larger loans to cover the cost.

Why is college so expensive?

Several factors contribute to the high price of college education. Jason Iuliano, J.D., a researcher at the University of Pennsylvania, said he believes a major contributing factor is the way college education is financed.

“Between the federal student loan system and supplemental private loans, students can borrow virtually unlimited amounts of money to attend college,” he said. “This incentivizes schools to compete on dimensions other than price.”

Many researchers point to decreased federal funding for schools as a major contributor to colleges’ rising tuition costs. In many cases, states don’t want to increase taxes to balance a budget, and some choose to cut education spending.

“It comes as a surprise to some people to realize that much of the increase in tuition at public schools is in response to decreased funding,” said Matt Birch, an assistant economics professor at Texas Lutheran University. “When a state government allocates fewer dollars per student, it should be expected that some portion of that cost will be passed on to students.”

Birch, who has a Ph.D. in economics, also said many students don’t understand how much they are really paying and what they are paying for, which makes it more likely they will accept price increases with little change to enrollment behavior. “Paying with loans may distort judgment, with students making short-sighted decisions,” he said.

How could the system improve?

The Department of Education is responsible for handling federal student loans, and the system currently makes it easy for students to access those loans. Contrary to a private student loan, borrowers do not have to go through a screening process, their credit is not reviewed and their debt and financial history are not reviewed either, making it difficult to identify those who are more likely to repay the loan.

This screening process doesn’t seem to be as important when it comes to federal loans because the repayment of a student loan is almost guaranteed by the system. Even those who file for bankruptcy are not exempt from repaying their loan. Iuliano believes this system encourages creditors to lend exorbitant sums of money to students, even though they know the person will have difficulty paying it off.

“Changing the laws governing the treatment of student loan debt in bankruptcy would have a significant effect on curtailing the rise of college costs,” he said.

Carrie Johnson, Ph.D., is a professor at North Dakota State University who acknowledges that some good changes have already been implemented into the system, but recognizes “the process of accepting and repaying federal student loans is overwhelming and confusing.”

Johnson said the Federal Student Aid website provides information about repayment options and financial awareness counseling, among other subjects.

When asked what changes could happen to the student loan system so it becomes more effective and helpful to students, Birch said, “allocating more public funds to universities would relax budget constraints, and schools would have less need to rely on tuition revenue.”

How much does price influence college choice?

Among other factors, price is a major factor taken into consideration when choosing which college to attend.

“In a study we conducted, we found that over 50% of those who responded indicated that the cost of the college influenced their decision to attend,” said Johnson.

Her research survey indicates most respondents would not have been able to attend college if they didn’t have access to student loans. The majority required loans not only to pay for tuition and fees but also for living expenses.

Because student loans are so easily accessible, many more students can attend college, but that also means colleges can charge more because they know students will find a way to pay. This would not be so much of a problem if colleges were investing in good quality education, but it seems like more and more colleges have been investing in school amenities, Iuliano said.

“For instance, Louisiana State University and the universities of Alabama, Iowa and Missouri have all installed lazy rivers on their campuses,” she said. “I’m sure that’s a fun selling point to students who are choosing between schools, but at the end of the day, it would be better if students weren’t taking on enormous debt burdens to pay for these luxuries.”

Easy access to federal student loans can be a turning point to a better life for many individuals, but it is important to understand everything that comes attached to it. The federal government does not charge students late payment fees, but if a few payments are missed, it could severely impact one’s credit rating.

Student loan debt is the second largest consumer debt in the U.S., behind only mortgage debt. According to State Higher Education Executive Officers’ annual report, 2017 was the first year that state schools received more money from tuition than from government funding.