The housing market in Utah County is a major consideration for BYU students, recent graduates and faculty members alike.

Students who are near graduation or have recently graduated may be preparing to purchase their first home, while faculty members may need an upgrade to accommodate growing families or may be looking for investment properties.

According to Jonathan Hanks, senior vice president and chief operating officer of the Utah Housing Corporation, the current housing market is on the upswing.

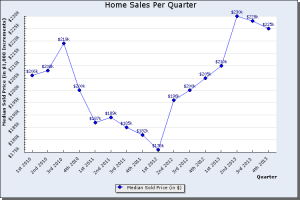

“The housing market in Utah went south in 2008,” Hanks said, “When property values are going down, people don’t want to jump in and buy a home because they think the market may go down further, and they don’t want to lose.”

Hanks said many homeowners were forced to sell at low prices, and others’ loans were foreclosed during the recession. This happened because loaners struggled to balance the devalued property on their books with enough credit.

According to Hanks, the housing market stabilized in 2011 and began to improve in 2012. During this period, property values ceased to drop and began to increase, he said.

“There is a projection that property values will continue to increase, although at a slower rate than last year,” Hanks said.

Linda Bills, owner of “I Love Real Estate,” said she believes the slowing increase in property values is an indicator that the window for prospective home buyers is shrinking.

“Because the market is still improving this year, but at a slower rate, in the near future, property values will peak and interest rates will go up,” Bills said.

Brad Moon, realtor at Century 21 Everest Realty Group, agreed with Hanks about the improvements in the market. According to Moon, the improving market is good for both buyers and sellers, as long as buyers have decent credit or have owned their current home long enough to have paid down their home loan.

Moon said this makes the market good for faculty members, who have owned their current home for a few years, to buy investment properties or upgrade if they can afford it.

Moon mentioned that a key benefit in the current market is the low interest rates currently available.

“Right now is a great time to get into a new house because the interest rates are as low as they will ever be,” Moon said.

Erin Kendrick, a recent BYU graduate, hopes to settle in Utah County. Kendrick is currently renting a home but spends time each week house hunting. According to Kendrick, the challenge is finding a house in her price range that fits her needs.

“I need a nice kitchen, and my husband wants a big garage. We really care about the neighborhood, so we are very picky about the location,” Kendrick said. “Once we put all of our needs into the house search, hardly any come up in our price range.”

Kendrick isn’t the only first-time home buyer who is struggling to find the right house. According to Hanks, the number of houses available in the lower price range is small.

“One area where we are seeing a challenge is for the first-time homebuyer market, which is in the $200,000-and-below price range,” Hanks said. “There (are) not as as many housing options available now as there has been.”

Moon said now is still a good time to buy a first home because financing is easier. He said the abundance of available credit has caused more lenders to be willing to finance down payments for first-time homebuyers, allowing those without a lot of savings to afford to buy a home.

“Most recent grads don’t have tens of thousands of dollars available for down payments,” Moon said. “Financing the down payment allows people in that situation to buy.”

Hanks said there are numerous nonprofit homebuyer education courses for first-time home buyers.

“If someone is looking to buy a home, it would be a good opportunity to avail themselves of taking some homebuyer education so they understand the process and what they ought to be looking for.”