Utah has the seventh-lowest default rate on student loans in the nation according to a comprehensive report by LendEDU released Oct 22.

LendEDU, an online loan marketplace specializing in student loans, compiled the most recent data from the U.S. Department of Education to look at which schools and states had the highest loan default rates.

A federal student loan is considered to be default when a payment is late by 270 days, or roughly nine months. Default standards for private loans vary, but a general standard is that loans are deemed in default when a payment is late by three or four months.

BYU has the 294th lowest default rate among all colleges in the nation, with a rate of only 1.50%, which is lower than the state average of 7.53%, the national average for private schools, 6.6%, and the overall national average of 10.1%.

Schools with three straight years of default rates above 30% become in danger of losing eligibility for the Federal Direct Loan Program and/or the Federal Pell Grant Program.

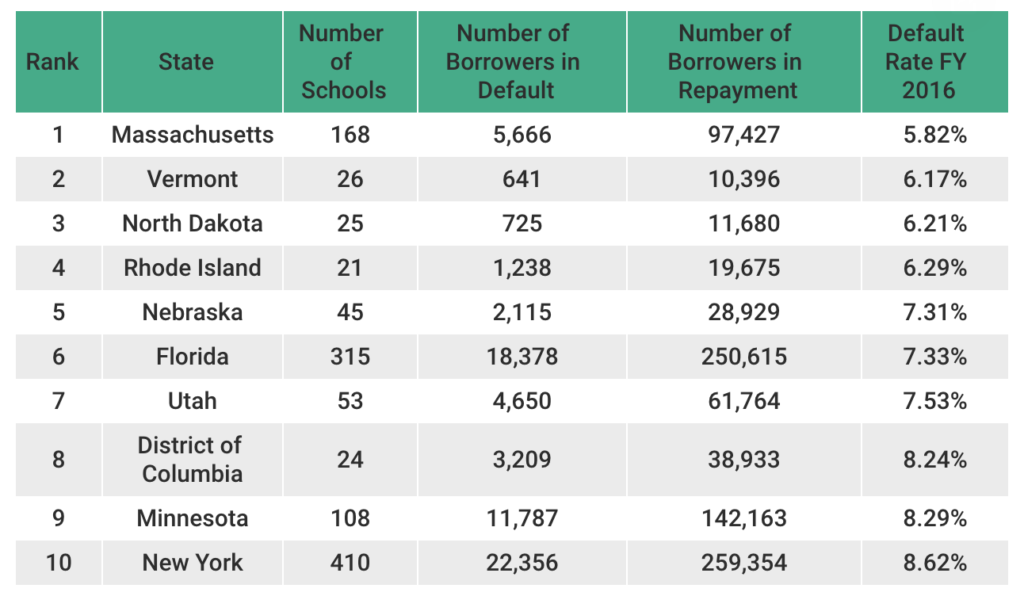

The study also showed that Southern states had very high rates and states in New England and the Midwest had the lowest default rates. Nevada had the highest default rate of 18.6%, with the next highest being Mississippi at 14.94%. Massachusetts had the lowest default rate, 5.82%, with the next lowest being Vermont at 6.17%.

Private schools like BYU rank lowest in terms of collective default rate at 6.6%, compared to 15.2% in for-profit schools and 9.6% in public schools.

Even though Utah and BYU are in relatively good standing in terms of default rates, BYU Financial Fitness Center manager Paul Conrad still wants students to make good decisions when applying for student loans.

“We’re trying to help students see if you need to borrow any money at all, how much you need to borrow and how much can you afford to borrow,” Conrad said. “We want students to make informed decisions before they decide to go into debt.”

The BYU Financial Aid Office is working on computer tools that can help students project what they should borrow given their future income, the type of education they want to receive and how many years it would take them to finish making payments.

“At the BYU Financial Fitness Center, we are looking beyond the default rate and look at the importance of the student and how we can help enhance their future,” Conrad said. “A lot of debt won’t enhance your future.”

In fact, the consequences of defaulting can be crushing. Individuals who default on a student loan can have tax refunds, Social Security benefits or wages garnished according to LendEDU. Credit scores can also be damaged and individuals may have to deal with lawsuits or debt collectors.

LendEDU reported that the national picture for U.S. student loan default rates is dismal, with outstanding student loan debt in the United States at an all-time high of $1.6 trillion and increasing student loan default rates.

Nursing major Claire Bernhisel knows first-hand the reality of student loans after taking one out to pay for her study abroad.

“It’s kind of scary, I don’t like being in debt,” Bernhisel said. “I’m hoping I can get a job soon after I graduate. People need nurses, so I’m pretty confident I can pay it off.”

Bernhisel believes that while student loans can be a burden, they are a necessity for people who want to succeed in the professional world.

“Student loans are a necessary evil. People have to take out student loans because nobody has that kind of money. BYU is affordable, but other schools aren’t, and often families don’t have that kind of money to send their kids to college,” Bernhisel said.