See also “Personal finance education critical for confidence and success in adulthood“

Only 17 states in the U.S. require high school students to take a financial literacy class to graduate. Pennsylvania is one of the 33 states that does not require this, nor does the state have standard testing for personal financial education.

However, Pennsylvania has recently moved towards allowing students to count up to one credit of personal finance credit toward graduation requirements for social studies, math, business education or family and consumer science. A bill is currently moving through the state legislature to make the change.

The move comes after state officials learned Pennsylvania has the second-highest average student loan debt per student in the U.S., according to Forbes. On average, each student in Pennsylvania owes $36,854 in student loans.

The survey also shows that Utah has the lowest average student debt per person in the U.S. at $18,838. Even so, student debt has been steadily rising for decades across the U.S.

Undergraduate students who received their bachelor’s degree during the 2016-2017 school year borrowed an average of $28,500 to pay for their schooling, according to the College Board. The total amount borrowed has increased by 3% from those who received their bachelor’s degree during the 2011-2012 school year, and that figure has continued to climb.

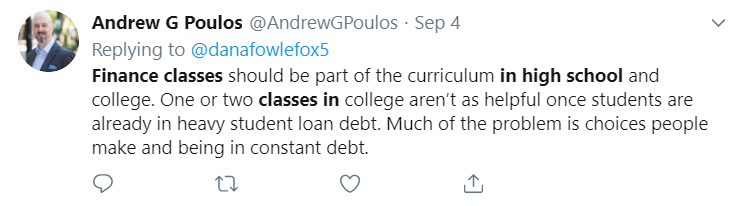

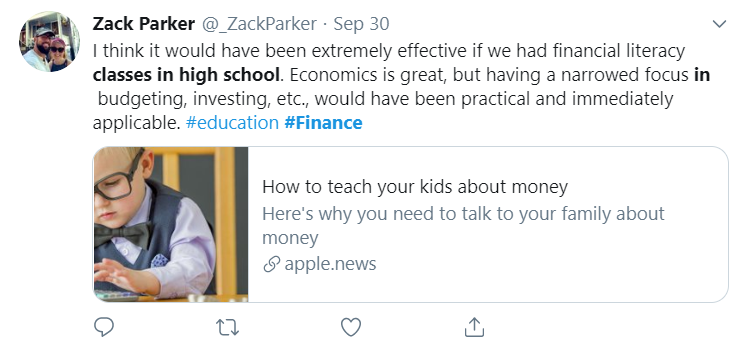

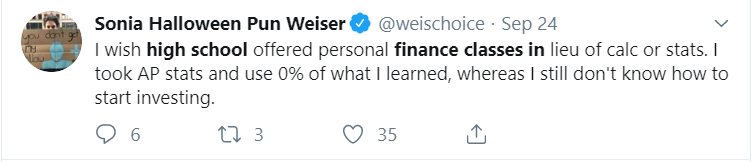

As the trend continues upward, there has been a lot of chatter, especially on social media, blaming the lack of personal finance education that takes place in high schools and colleges across the country.

Although personal finance education could lead to a better understanding of wiser financial practices, experts say that education alone may not be enough to keep students out of debt.

“A lot of our money behaviors are driven by emotion — not just knowledge,” said BYU family finances professor Jeff Dew. “So while personal finance education could help a student understand alternatives to debt and the problems that debt can bring, unless they also have a thrifty mindset or attitude, the education alone may not help them avoid debt.”

Both personal finance education and the practical implementation of skills and habits are key to avoiding debt.

Student debt isn’t the only financial worry young people face while attending college. Other kinds of debt may include car loans, credit card debt and consumer loans. Regardless of the kind of debt incurred, it can pose a serious threat to one’s financial security.

Research shows debt not only puts a strain on an individual’s wallet, but is also known to affect mental, emotional and social well-being.

“Research is clear that debt is associated with higher levels of stress, anxiety and depression, working more hours than one would like to work and even greater relationship conflict,” Dew said.

While debt can have a negative impact on personal well-being, student loans allow students to access graduate schools that would not be possible otherwise.

The most common type of student loans offered by the government are direct subsidized and unsubsidized loans.

Subsidized loans are intended to help undergraduates, and interest does not begin accruing until the student has dropped below half-time enrollment for at least six months. The government pays the interest while the student is in school.

Unsubsidized loans are available to help undergraduate and graduate students, but interest begins accruing at disbursement.

Students are able to apply for federal student loans, as well as federal grants, through the Free Application for Federal Student Aid.