Bitcoin, a popular cryptocurrency, debuted its futures on the New York Stock Exchange Late Sunday night.

Cryptocurrency is virtual currency exchanged worldwide with limited government regulation. This changed on Sunday when the cryptocurrency Bitcoin began trading its futures on the New York Stock Exchange, an organization overseen by the US Securities and Exchange Commission.

A future is an agreement between two parties to make a sale at a fixed date in the future, but for a price agreed upon in the present. A seller who predicts the value of the product will go down agrees to sell the product in the future for the current price. A buyer who predicts the value of the product will go up agrees to buy the product in the future for the current price.

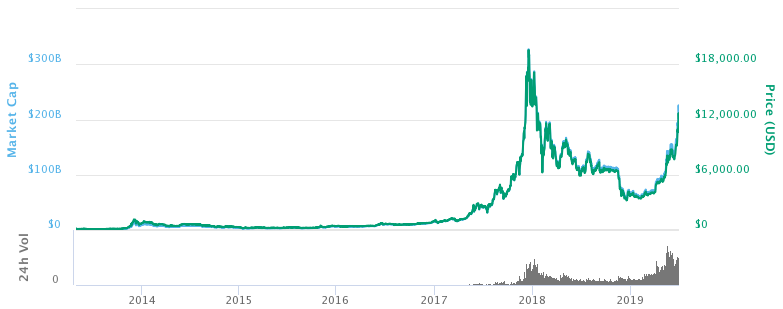

The value of a Bitcoin has proved volatile in the past and hindered its ability to expand, according to BYU Economics professor Scott Bradford. Since 2009, Bitcoin valuations have fluctuated drastically between under one dollar and over $18,000. Its appearance on the NYSE allows potential investors to hedge their bets and adds a level of stability, said the MIT technology Review.

This affiliation with the NYSE could also increase Bitcoin’s credibility with the public, according to Bradford.

“[Bitcoin] has attracted shady characters such as drug dealers and other criminals looking to move large amounts of money over national borders without scrutiny,” Bradford said. “They can do this because transactions are anonymous. Trading on a futures exchange requires regulatory approval, so that does bring legitimacy.”

The first Bitcoin future traded for $10,115 on the New York stock exchange, and the payouts will be paid out in actual Bitcoin.