BYU students expecting the birth of a child will need to decide what health plan best matches their needs without breaking the bank.

Zach and Jaelynn Horton had their first baby in June. The Hortons were stressed about the financial side of expecting the birth of a baby until they had found a health plan that worked well for them. After finding a financial solution that was best for their family, they were able to focus on things they deemed more important, like preparing to become parents.

“Trust in God. If you’ve gotten revelation that it’s time to start your family, even if you don’t know how you’ll afford it, trust in him and move forward in faith,” Jaelynn said.

Many people dream of the day they will become a mother or father but don’t always fully realize the significant strain having a baby can be on their wallet. This is only magnified without the proper knowledge of health insurance.

“Everyone gets stressed about the costs of having a baby. In fact, I know that’s why some people choose not to have children,” said BYU student and expecting mother Kimberly Petersen.

Studies have found that stress not only affects the soon-to-be parents, but it can also impact unborn children.

Financial stress felt by pregnant mothers can be influential on a baby’s health at the time of birth, according to a study conducted by the Ohio State University Wexner Medical Center.

In the study, women who were more stressed about finances during their pregnancy were at a higher risk to give birth to babies of lower birth weight. Low birth weight is associated with a likelihood that the child later develops heart disease, obesity and respiratory and digestive problems.

This, in turn, could cause additional hospitalization and treatment costs which add to the new parents’ burden.

Soon-to-be parents can evaluate various health care providers to see which insurance plan will allow them to best manage the financial side of having a baby.

“I’ve done my research. However, I wish that insurance plans would solicit their maternity coverage more openly. I only heard about my options through other women who had recently had babies,” Petersen said.

Maternity coverage is listed as one of the 10 essential benefits that have to be covered by health insurance plans offered to individuals and families.

Only 12 percent of individual market health plans covered maternity costs in 2013, according to the National Women’s Law Center.

Health plans were mandated to begin covering pregnancy, labor, delivery and newborn baby care under the Affordable Care Act in 2014. This policy is commonly referred to as ‘Obamacare.’

One of the main purposes of the Affordable Care Act was to “make affordable health insurance available to more people,” according to healthcare.gov. However, all health plans and maternity coverage are not created equal.

“Couples should review multiple health insurance policies because different policies offer different benefits at different price levels. Couples need to find the policy that is most affordable that will also meet their own family’s needs,” said BYU professor of family finances Jeff Dew.

Without reading all the details of the coverage or properly understanding all the insurance lingo, unanticipated charges and deductibles may leave new parents feeling overwhelmed and possibly incapable of paying their bills.

“Sometimes you may have to pay more to get the policy that meets your needs, but it’s better to have all your needs met than to pay less on the insurance but pay more of the medical bill because you have inadequate insurance,” Dew said.

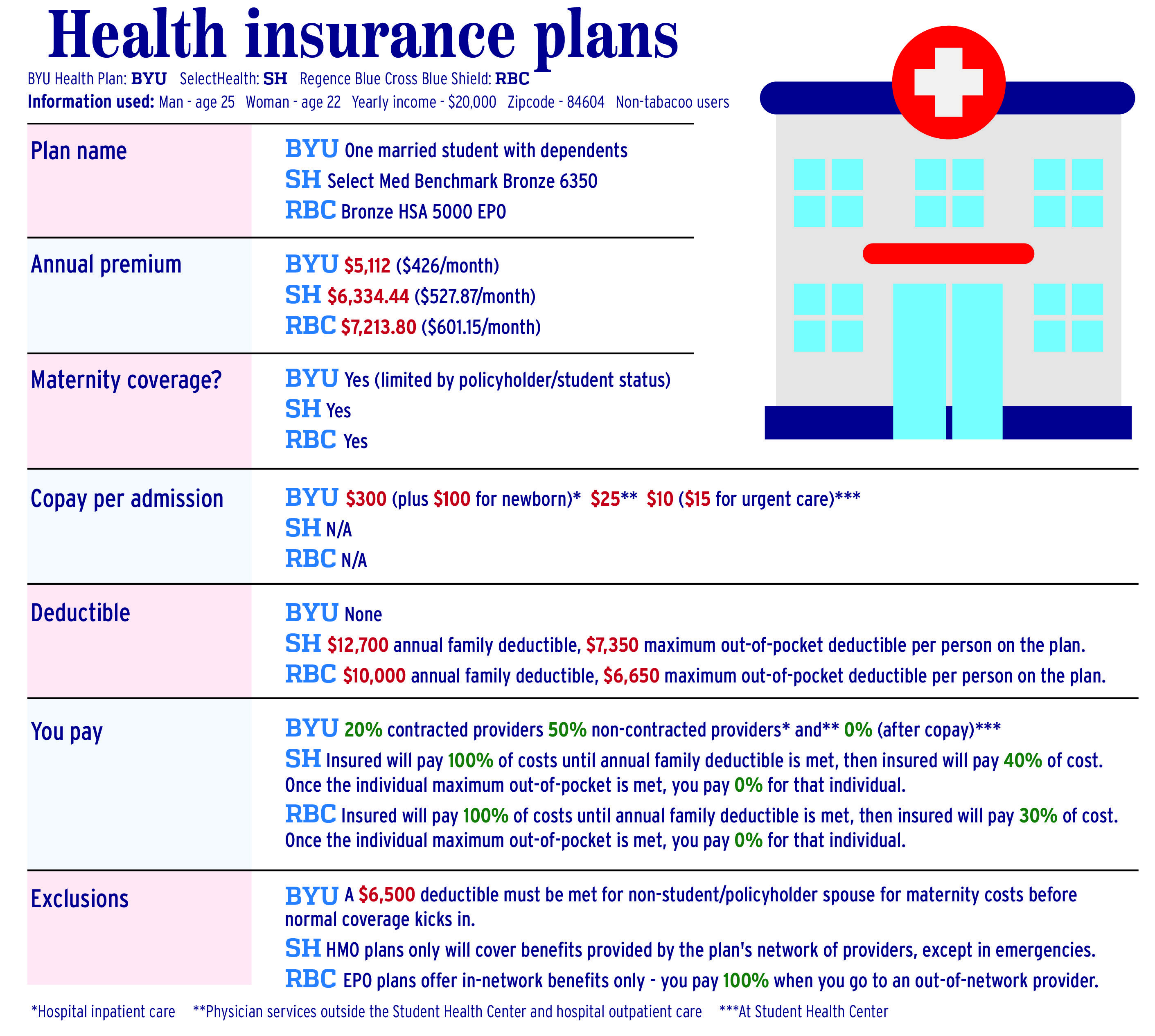

The BYU Health Center offers health plans for BYU students and their dependents. The premium for insurance for one married student with dependents for the 2017–2018 year on the BYU Health Plan was approximately $5,112. However, only the policyholder or BYU student is covered under the normal health policy when it comes to maternity costs.

If the spouse of the student/policyholder is the one to give birth, there is a clause added in fine print to explain the stipulations:

“Maternity coverage is included for all students/policyholders. Non-student spouses must meet a $6,500 deductible per pregnancy for all maternity services before they can receive regular benefits,” according to the BYU Health Plan brochure.

Deductibles are defined as “the amount you pay for covered health care services before your insurance plan starts to pay,” according to healthcare.gov.

Eighty percent of coverage for physician services outside the Student Health Center, hospital outpatient care and hospital inpatient care is typically paid for by the plan after the set copay amount is paid. Twenty percent of the charge is the insurance beneficiary’s responsibility.

Copayments, or copays, are defined as “a fixed amount you pay for a covered health care service,” according to healthcare.gov.

Typically plans with lower monthly premiums have higher copays. Health plans with higher monthly premiums normally have lower copays.

The following two insurance companies and selected policies are based on a 22-year-old woman and a 25-year-old man living in Provo who make approximately $20,000 annually. The couple is not yet pregnant and has no pre-existing conditions.

SelectHealth is a common health insurance company used in the Utah Valley. It offers health insurance to more than 850,000 people in Utah and Idaho, according to its website.

One plan through SelectHealth is called ‘Select Med Benchmark Bronze 6350.’ The monthly premium for this plan is $527.87, making the annual premium a total of $6,334.44.

With this plan, the insured will pay 100 percent of the medical costs incurred until the annual family deductible of $12,700 is met. When the annual family deductible is met, the insured will pay 40 percent of medical costs.

Once the individual maximum out-of-pocket of $7,350 is met, medical costs will be completely covered by the insurance for that individual. There is no copay for this plan.

Those insured by SelectHealth need to be aware that HMO plans only cover benefits provided by the plan’s network of providers, except in emergencies.

Regence is a member of theBlue Cross Blue Shield — another health company that serves Utah, Idaho, Washington and Oregon.

One plan through Regence is called ‘Bronze HSA 5000 EPO.’ The monthly premium for this plan is $601.15, making the annual premium a total of $7,213.80.

With this plan, the insured will pay 100 percent of the medical costs incurred until the annual family deductible of $10,000 is met. When the annual family deductible is met, the insured will pay 30 percent of medical costs.

Once the individual maximum out-of-pocket of $6,650 is met, medical costs will be completely covered by the insurance for that person. There is no copay.

Those insured by Regence through Blue Cross Blue Shield are only covered when they go in-network. If the insured go to an out-of-network provider, they will always be responsible to pay for 100 percent of those services.