Daniel Lemich is spending his summer in his hometown of Rawlins, Wyoming, selling cars. Lemich, 22, is a senior in construction management at BYU. Like many other students, he is working hard to save money for family and school expenses. But he’s also squirreling away cash for investment opportunities.

“I know that the earlier you start investing, the better,” Lemich said. “I had some extra cash, so I decided to invest it to save that money.”

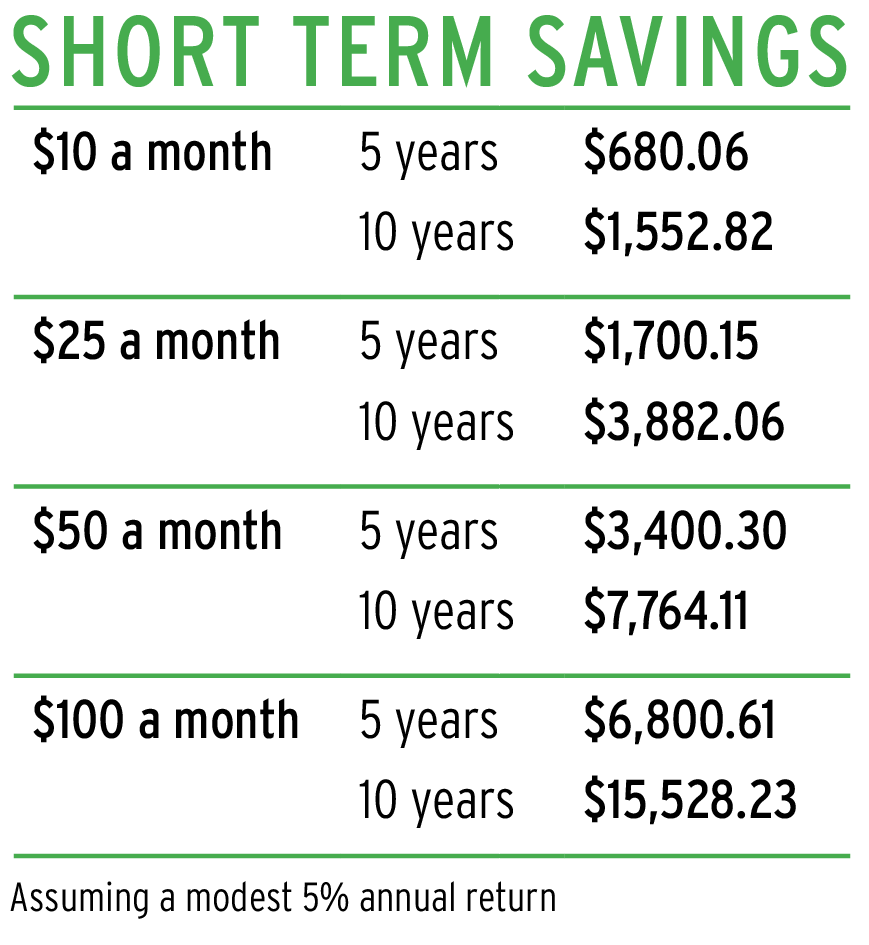

Savings are exponentially bigger for those who begin saving as early as possible and who wisely invest their money. BYU finance professor Jim Brau teaches his students about the time value of money.

“Compound interest is the idea behind the time value of money, meaning if you have a dollar and you can invest it, it will earn interest between today and tomorrow,” Brau said. “The next day it will earn interest not just on the amount you invested, but also on the interest you have earned. The longer you are able to invest your money, the greater the time that the compound interest can take effect.”

Money saved now will grow more the longer it is invested, depending on the rate of return. Low-risk investments like bonds can earn around 5 percent. On the other hand, financial guru Dave Ramsey suggests in his book “The Total Money Makeover” that the Standard and Poor’s (S&P) 500 index has historically yielded an average 12 percent each year. The S&P is an American index based on 500 large companies with common stock on the New York Stock Exchange (NYSE).

BYU family finance professor Jeff Hill makes sure that his students understand the importance of saving money as early as possible.

“You should start saving early, even if it is just a little bit; it’s to get in the habit of doing it, even if it’s just a little bit each month, because then as you make more money in the future, you can save more and more,” Hill said. “I suggest that everyone should be investing some money every month, even if it is only $5.”

Brau and Hill teach their students that there are many ways to begin investing now that will pay off in the long run. A few of these options include Acorns, Betterment, Roth IRAs and paying off debt.

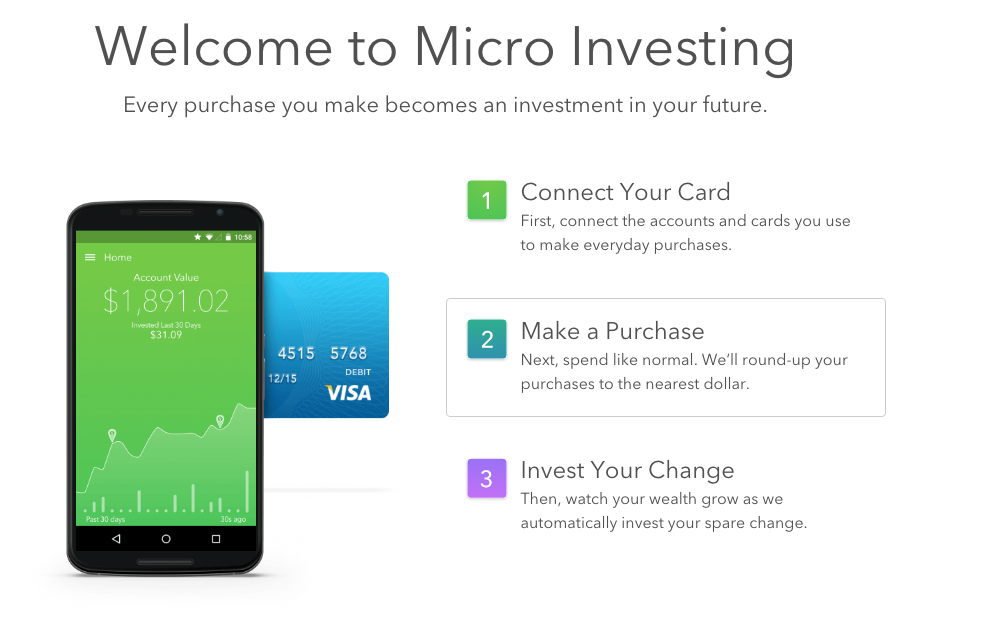

Use the app Acorns

“Acorns is so easy to use,” Hill said. “It is the first step that a student can take because it’s putting away a little bit a month.”

Acorns is a smartphone app and website that is connected to the user’s checking account. Each time that account is used to make a purchase, Acorns rounds up the change to the nearest dollar and invests that change for the user automatically. Basically, it saves the user’s spare change for them.

“You turn around in six months and you have a few hundred dollars there and by the time you graduate you could have a few thousand there, and you haven’t even noticed the money going in,” Hill said.

Open a Roth IRA

Betterment is also a smartphone app, targeted for those intending to save more than they would with Acorns. With Betterment, users open a Roth IRA.

According to Dave Ramsey’s website, “A Roth IRA is a type of account that allows the money you invest for retirement to grow tax-free. When you retire, the withdrawals you make from your Roth IRA are also tax-free.”

It is a greater investment and commitment than Acorns, but it also has greater reward potential in the long run.

“If your tax rate is lower now than it will be in the future, it’s better to do a Roth IRA. That’s why it is best for most students to start a Roth IRA,” Brau said.

The money in a Roth IRA can also be withdrawn penalty-free after five years for a first home or continuing education. See http://www.rothira.com/ for all of the details about Roth IRAs.

Paying off debt

Any debt that students have are investments when they pay them off. Student loans, car loans and credit card debt are all common for college students.

“Any money that you use to pay off a debt is like investing that money at whatever your interest rate is,” Hill said. “If you have credit card debt and are paying 18 percent per year on that debt, every payment that you make to pay that off is like investing that money and getting a return of 18 percent.”

Both Hill and Brau encourage their students to stay out of debt. They say home mortgages, a modest car loan and educational expenses are appropriate debts, but students should be cautious about incurring more debt than they can pay off.

Students can take classes to learn how to better save money and manage investments. Different courses about personal and family finance available to BYU students include personal finance (FIN 200), principles of finance (FIN 201) and family finance (SFL 260).