The Senate voted to pass the largest tax overhaul in more than three decades in a 51-47 vote on Dec. 5.

However, the Senate bill differed from the version of the bill passed in the House of Representatives in November by excluding new legislation to repeal the Johnson Amendment.

The House and the Senate will reconvene to work out the differences between the two bills, and GOP leaders expect to pass a unified bill by Christmas, according to the Associated Press.

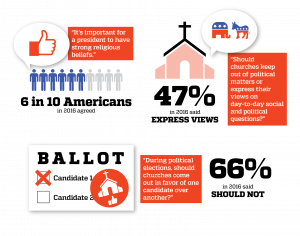

Repealing the Johnson Amendment would give tax-exempt institutions such as nonprofits, religious organizations and churches the ability to legally donate to, and endorse, political candidates.

This change could cause concerns in the community about whether or not political candidates are donating to nonprofit and religious organizations for political endorsements and advancements, according to Chase Thomas, the policy and advocacy counsel for Alliance for a Better Utah.

Alliance for a Better Utah is an organization committed to creating balance, transparency and accountability within Utah politics and government. The Alliance is trying to raise awareness among the community about the Johnson Amendment and how its repeal could have a huge effect on the societal framework, according to Thomas.

The Johnson Amendment says religious organizations and churches “can’t endorse candidates, can’t donate to political campaigns or be involved in them. It separates (church and state),” Thomas said.

The amendment is a law named after President Lyndon Johnson when he was in the Senate. In recent years, Republicans’ concerns for the law have pushed for a repeal through the current tax overhaul which includes significant tax cuts for businesses, individuals and families, according to the Associated Press.

“(The Johnson Amendment) was meant to sort of reinforce our nation’s understanding of the separation of church and state. If these organizations were going to receive preferential treatment through the tax code by tax-deductible donations, then they should not be involved in the political side,” Thomas said.

Cole Durham, the Susa Young Gates university professor of law and founding director for the International Center for Law and Religion Studies at BYU, said repealing the Johnson Amendment won’t make much of a practical effect because “the IRS hasn’t been enforcing (the Johnson Amendment) for years.”

Durham said maybe one case in the last 50 years has been enforced by the IRS. What happens, according to Durham, is that on a particular Sunday, many churches will endorse candidates and then send a letter to the IRS to see if the IRS will do anything about it. A letter from the IRS will come back stating the churches are in violation of the Johnson Amendment but that they won’t be enforcing it.

“And the result of that is the religious groups do not have standing to bring an action to challenge the constitutionality of the Johnson Amendment because there’s no enforcement against them,” Durham said.

However, the push to repeal the Johnson Amendment stems from many churches view the Johnson Amendment as an “impermissible constraint on free-speech rights,” according to Durham.

The Utah Nonprofits Association posted on its Facebook page, “The House tax reform bill (H.R.1) significantly weakens the Johnson Amendment and creates an incentive for special interest groups to funnel untraceable campaign contributions through nonprofits.”

If the Johnson Amendment is repealed, Thomas said it could cause concerns for the community with backchannel funding to politics.

“We wouldn’t know if (politicians) are donating to these (tax-exempt) organizations to try and get an endorsement because their donations don’t have to be reported,” Thomas said.

President Trump used the Johnson Amendment topic as a political advantage to appeal to more conservative evangelicals and to ultimately attract more evangelical support during his presidential campaign, according to Durham.

Although some religious groups are pushing to see the Johnson Amendment repealed, Durham said he thinks that most mainline denominations want to keep the Johnson Amendment.

“For a lot of denominations, the Johnson Amendment protects them from having to take sides on political issues. And they’ll have a broad spectrum of political beliefs among their congregants,” Durham said. “So it makes life much easier if they just have a legal reason for saying ‘it’s not legal for us to takes sides.’ It facilitates their remaining politically neutral on political campaigns.”

The Church of Jesus Christ of Latter-day Saints has an official statement explaining the church’s stance on political neutrality. The statement explains that the church doesn’t “endorse, promote or oppose political parties, candidates or platforms” but it does “encourage its members to play a role as responsible citizens in their communities, including becoming informed about issues and voting in elections.”

Durham said this has been a topic among religious organizations and churches over the years, but this time things are different because President Trump is willing to support the repeal.

“Democrats have generally opposed (repealing the Johnson Amendment), so having a situation where you’ve got a Republican-controlled House, a Republican Senate and a Republican White House, it makes it possible and feasible in a way that it hasn’t been before,” Durham said.

While some people feel repealing the Johnson Amendment will affect the community at large, Durham said he thinks things won’t change that much.

“In terms of practical consequences, it’s not going to make much of a shift because the churches who really want to do this have (already) been endorsing candidates,” Durham said.

Click on the following links to view copies of the bill that passed in the House and the one that passed the Senate.