Utah Gov. Gary Herbert’s proposed electronic cigarette sales tax increase has been met with criticism from groups that say e-cigarettes help smokers quit.

E-cigarette advocates like the American Vaping Association and the Utah Smoke-Free Association say increased taxes will discourage smokers from making a smarter choice.

E-cigarettes separate the nicotine from the tobacco combustible, unlike traditional cigarettes. Aaron Frazier, founder of Utah Vapors, spoke on behalf of the Utah Smoke-Free Association, saying nicotine is not what people make it out to be. “Scientists around the world say nicotine in itself does not appear to be overly addictive. It does not cause death or other diseases and overall is not a bad product,” Frazier said.

Marty Carpenter, spokesman for Herbert, explained the governor’s reasoning for the tax. “Similar to conventional cigarettes, electronic cigarettes contain nicotine and other harmful, addictive substances,” he said.

Advocates argue that e-cigarettes actually reduce harm. Frazier said studies have shown e-cigarettes cause 98 to 99 percent less harm than do combustible tobacco cigarettes. “We certainly don’t want people to pick it up as a habit if they’ve never smoked. But does it happen? Yes. The same way someone picks up drinking and becomes an alcoholic,” Frazier said.

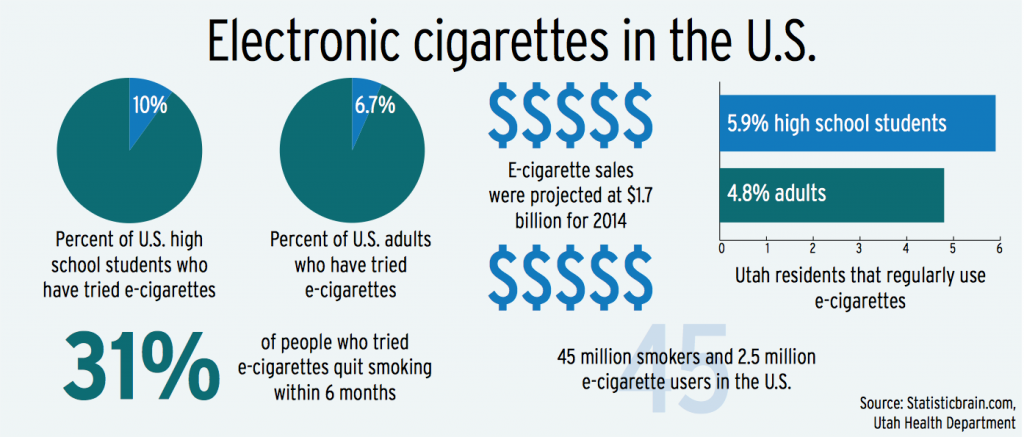

Gregory Conley, president of the American Vaping Association board, said e-cigarettes “are undoubtedly helping smokers quit.” Utah has the lowest smoking rate in the nation, but 230,000 long-term smokers still live here, and 50 percent of them will smoke until they die. “We believe it is not good public policy to tax companies that help smokers quit.”

The governor’s office justifies the tax as a re-definition of existing cigarette taxes. “As marketing and sales of electronic cigarettes increase, similar taxation and regulations should be enforced,” Carpenter said.

Frazier believes the taxation will be on the e-liquid itself, which would increase the price of vapor products 40 to 80 percent from their currently marketed price. He speculates that, similarly to any retail business, inessential increase in product price will send customers away.

Cigarette sales continue to decline across the country as their tax rates have increased. The tax proposal would serve to offset this decline and maintain the revenue that comes from current cigarette tax. Frazier projects that if customers go elsewhere and business shuts down, this tax will have “the net opposite effect of what the government is wanting.”

Utah’s law prohibits anyone under 19 from smoking either traditional or electronic cigarettes. The vapor industry has received criticism for marketing to minors. “This is in demand. We are not marketing to a younger market; this is for adult consumers,” Frazier said.

Beyond the tax policies there is a disparity in the perception of the product itself. “In Utah we have a state that is ideologically opposed to nicotine in a way that really no other state in the U.S. is,” Conley said.

Advocates like Conley recognize the product’s pitfalls but maintain that e-cigarettes can help smokers quit a detrimental habit.

Carpenter maintains the view that “taxation and regulations should be enforced to protect public health.”